A new global dataset covering international transactions from 1800 to the present.

Developed by Gastón Nievas and Thomas Piketty, WBOP harmonizes balance of payments data across time and countries, enabling long-run comparative analysis of trade, capital flows, and foreign wealth accumulation.

The database includes annual series for 57 core territories (48 main countries and 9 residual regions) covering 100% of the world population and GDP on a consistent basis througout the period 1800-2025.

The database is accompanied by a working paper and is intended as a public good for researchers, journalists, policymakers, historians and all interested citizens.

Research

Unequal Exchange and North-South Relations: Evidence from Global Trade Flows and the World Balance of Payments 1800–2025

(G. Nievas, T. Piketty, WIL WP 2025/11, May 2025)

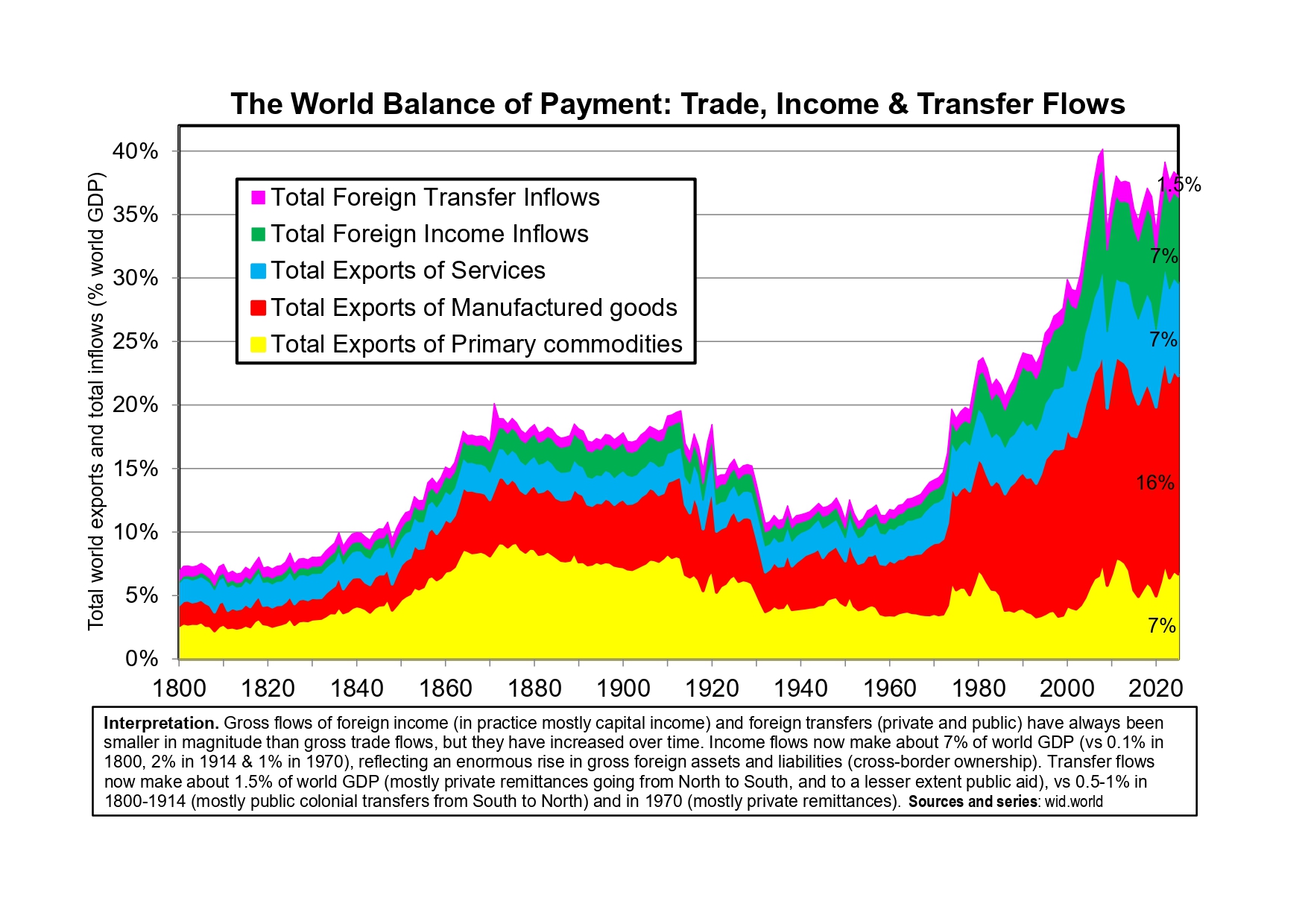

Abstract: This paper constructs a new database on global trade flows and the world balance of payments (including goods, services, income and transfers) covering 57 core territories (48 main countries + 9 residual regions) over the 1800–2025 period. This allows us to analyze patterns of global imbalances, current account surplus/deficit and net foreign wealth accumulation over more than two centuries. We quantify the role of colonial transfers and low commodity prices (due to forced labor and other factors) in the build-up of Europe’s foreign wealth during the 1800–1914 period. We compare this experience to the global imbalances which developed during the 1970–2025 period. We stress the persistent role of unequal bargaining power and terms of exchange and the need for collective rules. We also provide counterfactual simulations on foreign wealth accumulation under alternative trade & monetary regimes.

Download the working paper (pdf)

Download the presentation slides (pdf)

Data

Download the full WBOP dataset (xlsx)

Download the main figures and tables (pdf) (xlsx)

Download the full set of appendix figures (pdf) (xlsx)

Download the full replication package (zip)

Brief history of the Balance of Payments

Origins

The term “Balance of Payments” dates back to the 14th century, but its modern usage emerged in Sir James Steuart’s An Inquiry into the Principles of Political Economy (1767). See Badger (1951).

Early national compilations & League of Nations

After World War I disrupted global trade, the League of Nations mandated at its Third Assembly (28 September 1922) the systematic collection and publication of national BoP data. Its first report appeared in 1924, covering 13 countries: League subcommittees refined BoP concepts through the 1930s and reconvened in December 1945 to set the course for postwar international statistics.

IMF & the BPM series

- BPM 1 (1948): First edition adopted January 1948, fundamentally based on the developments of the LoN.

- BPM 2 (1950): Quick update to introduce refinements for greater comparability between countries.

- BPM 3 (1961): Introduced more detailed sectoral tables.

- BPM 4 (1977): The collapse of the Bretton Woods system of fixed exchange rates had a big impact on international financial markets, which resulted in an update of the BPM. These changes were salient in the financial account, where subcategories were introduced to gather better information to analyze the financial market evolution.

- BPM 5 (1993): Integrated International Investment Position (IIP), allowing for links between outstanding stocks of foreign financial assets and liabilities and their related changes (i.e.: transactions, valuation changes). Capital transfers were moved out of the current account and incorporated into the newly expanded capital and financial account. It also expanded the coverage of trade in services, which grew substantially.

- BPM 6 (2009): IIP became central in the analysis, to the point where the manual was renamed to include it in the title. This new focus was the result of the BoP crisis that developing countries experienced in the 90s and early 2000s. Due to the rise of trade in services and trade in intermediate goods, the manual enhanced its coverage of both.

- BPM 7 (2025): Fully integrating flows and stocks and addressing globalization and digitalization. Countries are encouraged to implement the new standards by 2029–2030.

Over nearly eight decades, BoP standards have grown from basic goods, services, migration, and finance entries into a comprehensive external accounting system indispensable for modern economic analysis.